Most employee benefits are built for the employee—insurance, perks, retirement savings. All good things. But what if there was a benefit that gave both the employee and the employer a financial win every month?

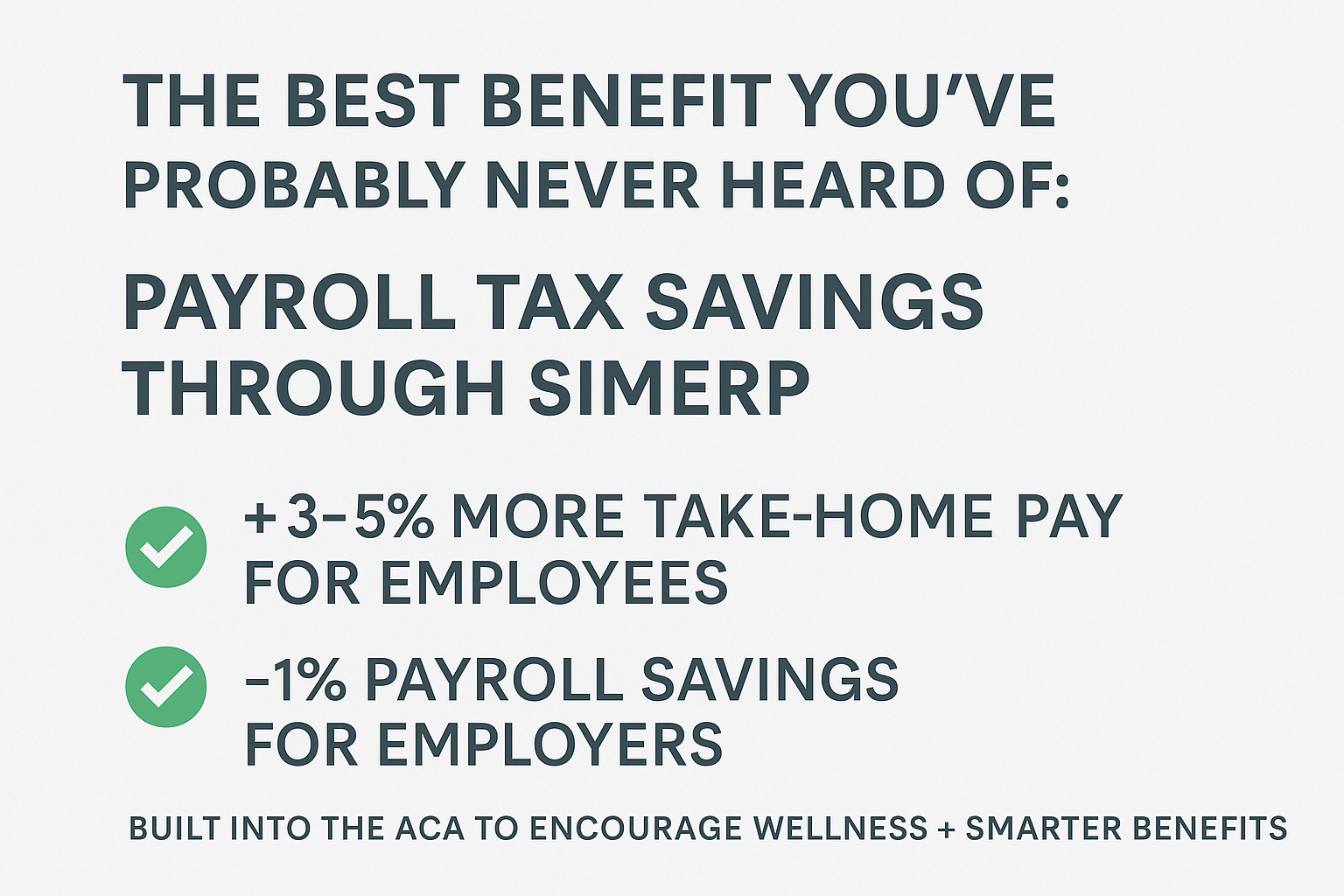

That’s the idea behind SIMERP programs (Self-Insured Medical Expense Reimbursement Plans). These little-known, ACA-compliant programs do two things at once: they encourage preventive wellness and they lower payroll taxes for both sides.

The Affordable Care Act (ACA) wasn’t just about access to care—it was also about bending the cost curve. One way was by motivating people to stay healthier through preventive screenings, checkups, and wellness activities.

SIMERP programs were written into the law as a way for employers to encourage wellness participation while also easing the tax burden. Instead of wellness being a “soft perk,” these programs make prevention financially smart.

That may not sound like much at first glance—but across dozens or hundreds of employees, it stacks up quickly.

SIMERP programs don’t just move numbers on a paycheck. They also deliver real wellness support: preventive screenings, health coaching, fitness discounts, and lifestyle resources that help employees stay healthier. We even have an option for Financial Wellness training.

Healthier workforce. Higher satisfaction. Lower long-term healthcare costs.

Mostly awareness. Many leaders (and even HR pros) don’t know this option exists, or they assume wellness programs are just “feel-good” add-ons.

But when you consider the tax advantages and the wellness outcomes, SIMERP programs become a powerful, underused tool in the benefits playbook.

If a program can improve employee health and boost everyone’s financial results, why wouldn’t you use it? Check out our Employee Benefits page and drop us a note to learn more.

Copyright © 2025. All rights reserved. | Privacy Policy | Terms of Service